20-year Returns Outlook

Our Temasek Geometric Expected Return Model, or T-GEM, simulates the range of possible returns for our portfolio over the next 20 years. These simulations do not predict actual outcomes.

Jump to

(for year ended 31 March)

Economic Scenario-Based Approach

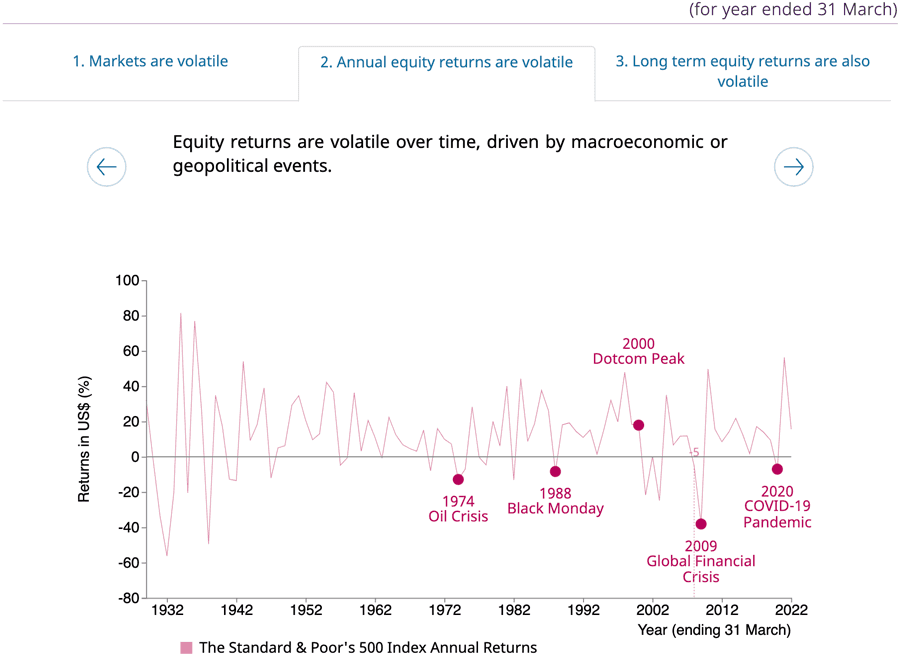

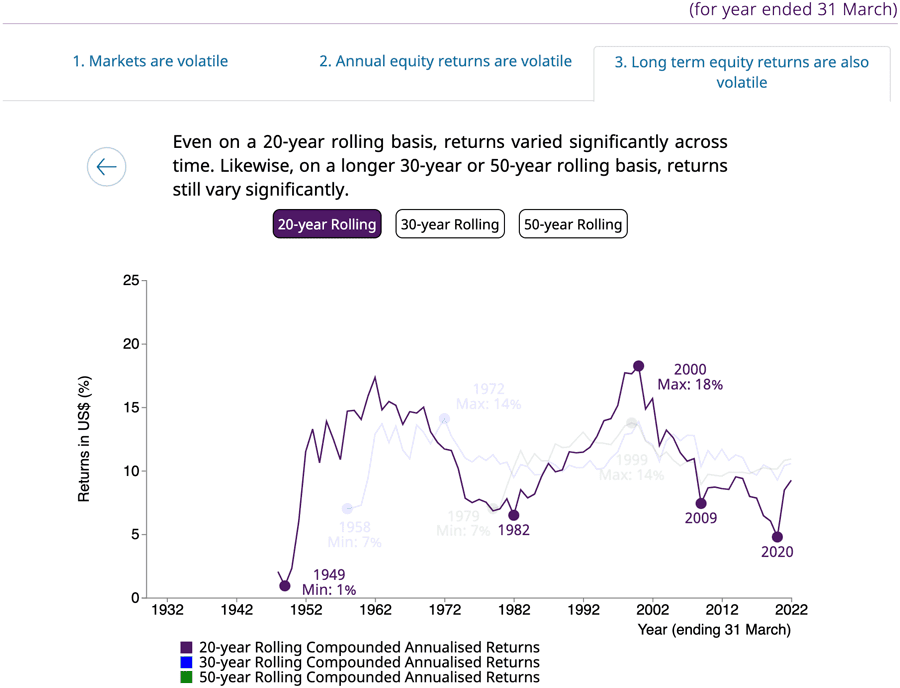

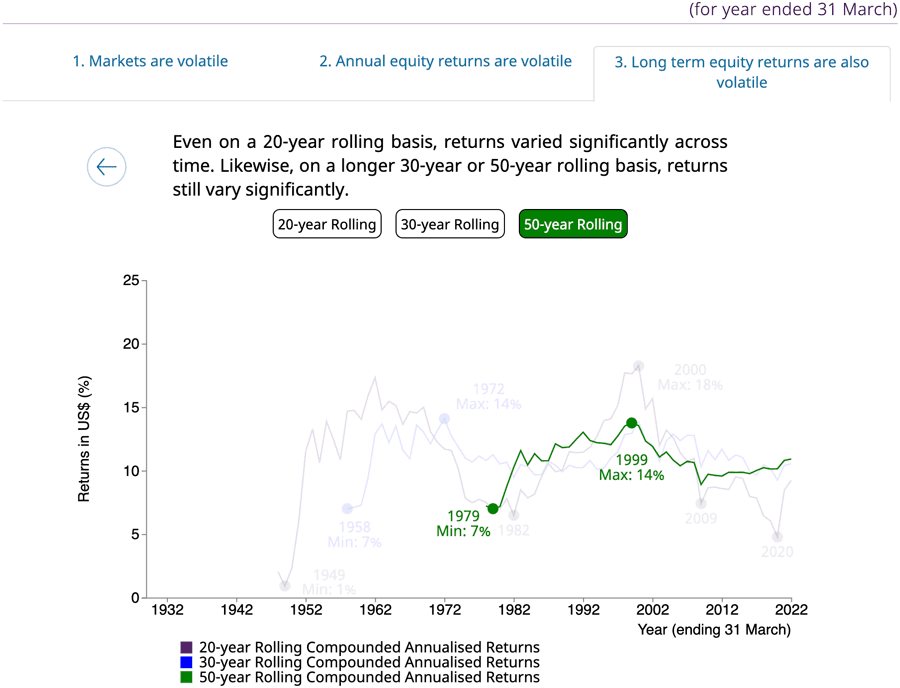

Equity returns are volatile over time, and influenced by macroeconomic or geopolitical events and shocks. Hence, T-GEM uses a scenario-based approach to simulate our 20-year long term expected returns. This approach takes into account our views of long term macroeconomic fundamentals over the next 20 years, adjusted for current market valuations.

Projection Based on Economic Fundamentals

In projecting economic fundamentals, we make more granular year-to-year assumptions for the first five years, and transit to more general assumptions based on longer term fundamentals as we go beyond 10 years. This “pathing” approach incorporates assumptions about changes in economic conditions over time. We do not assume an equilibrium return that remains unchanged over the 20-year period, nor do we assume a reversion to the historical mean.

Economic Scenario Pathing (Illustrative)

20-year Expected Returns for Different Portfolio Mix

The charts below illustrate the simulated returns for a Global Bond Portfolio, a Global Equity Portfolio and the Temasek Portfolio. The simulations are based on our Central Scenario.

The Global Bond Portfolio has the lowest upside potential, as compared to the Global Equity and Temasek Portfolios. It also has the least volatility, as shown by its narrower year-to-year annual returns distribution curve.

The Temasek Portfolio has the highest upside potential (see blue shaded) at the end of the 20-year period, but also the highest volatility.

(as at 31 March 2022)

Likelihood of Geometric Returns (Compounded Annualised) at the End of 20-year Period, by Portfolio Mix

(as at 31 March 2022)

Likelihood of Year-to-year Annual Returns during 20-year Period, by Portfolio Mix

20-year Expected Returns for Various Temasek Scenarios

We simulate our 20-year expected returns under different scenarios.

Potential Scenarios for 2022 and Beyond

| Potential Scenarios | Description |

|---|---|

|

Central (Our most likely scenario) |

Our baseline expectations of growth that also includes longer term challenges such as climate change. |

|

Differing Climate Change Pathways (Less likely scenarios) |

Our “High Ambition” scenario assumes greater mitigation efforts to slow the rise in temperatures. Our “Low Ambition” scenario assumes no further mitigation efforts, which results in a disastrously steep rise in temperatures by 2100. |

|

Acute US Monetary Shock (Less likely scenario) |

A combination of persistent supply shocks and an overly accommodative monetary policy results in loss of the inflation anchor. This forces the Fed to tighten policy at an even more aggressive pace than what we predicted in our Central Scenario. Tightening of policy over extended period of time triggers a deep US-led global recession. |

|

Further Escalation of Global Strategic Rivalry (Less likely scenario) |

A significant intensification of the Russia-Ukraine conflict, resulting in a global recession, but with elevated prices as global supply chains remain constrained. |

|

China Hard Landing (Less likely scenario) |

A disorderly and prolonged slowdown in growth may result from slowness to rebalance the economy and address risks in the financial system and corporate debt-related vulnerabilities. |

The T-GEM 20-year returns curves for the Temasek Portfolio are shown below for the Central, Differing Climate Change Pathways, Acute US Monetary Shock, Further Escalation of Global Strategic Rivalry, and China Hard Landing Scenarios.

Broadly, the Central Scenario offers higher 20-year expected returns for the Temasek Portfolio, compared to those under the other alternate scenarios. The exception is the High Ambition Climate Change Scenario, where there is concerted effort and strong actions to mitigate climate change and carbon emissions, for a more liveable world.

(as at 31 March 2022)

Likelihood of Geometric Returns (Compounded Annualised) at the End of 20-year Period, by Potential Scenario

(as at 31 March 2022)

Likelihood of Year-to-year Annual Returns during 20-year Period, by Potential Scenario

The four charts below show the positive impact of the High Ambition Climate Change Scenario on the 20-year returns in the four key markets of the US, the Eurozone, China and Singapore. These markets make up 74% of Temasek’s underlying portfolio exposure as at 31 March 2022, and will consequently also drive higher 20-year returns for Temasek. However, the associated transition costs may depress returns slightly over the next decade or so, as a medium term trade-off.

(as at 31 March 2022)

Market Index Value at the End of 20-year Period, by Potential Scenario (US)

(as at 31 March 2022)

Market Index Value at the End of 20-year Period, by Potential Scenario (Eurozone)

(as at 31 March 2022)

Market Index Value at the End of 20-year Period, by Potential Scenario (China)

(as at 31 March 2022)

Market Index Value at the End of 20-year Period, by Potential Scenario (Singapore)

A High Ambition Climate Change agenda will not only deliver environmental and social benefits. Our T-GEM model highlights that the High Ambition scenario is compatible with our aim of doing well, doing right, and doing good, to deliver better and more sustainable returns over the longer term horizon, even as we benefit people and planet with ambitious carbon abatement actions.

In contrast, the Low Ambition scenario of no further mitigation efforts will result in huge irreversible physical damages which will depress longer term returns in all markets.