Investment Update

We continue to shape our portfolio in line with long term structural trends, while managing the risks and opportunities arising from macroeconomic and market events.

Jump to

We remained very active during the financial year ended 31 March 2022, investing S$61 billion and divesting S$37 billion.

Our level of investments remained elevated as we continued to position our major portfolio companies for growth in a post-COVID world, and amid driving forces of the low-carbon energy transition. Meanwhile, we kept up capital deployment into opportunities aligned with our focus on structural trends, and de-risked certain positions that faced major near term headwinds. Consistent with the past, we realised gains from divestments based on our intrinsic value tests and our disciplined approach towards recycling our capital in the continuous reshaping of our portfolio.

We kept up capital deployment into opportunities aligned with our structural trends, and de-risked certain positions that faced major near term headwinds.

Aligning Investments with our Environmental, Social and Governance (ESG) Framework

The transition towards low-carbon economies and sustainable lifestyles is not only an imperative, but also presents us with new investment opportunities. We have increased our focus on businesses with innovative products, services and business models that drive decarbonisation, resource efficiencies, and material and process innovation. We have also forged partnerships with like-minded investors who are committed to achieving a net zero world to scale feasible and novel solutions in energy, mobility, built environment and manufacturing.

Our ESG integration framework is a key part of our investment process. By including materially relevant ESG considerations, we enhance our existing investment practices, support our investment decision making, and safeguard Temasek’s reputation. Making ESG integral to decision making aligns well with our objective of generating sustainable returns and our focus on investing with a long term view. It also frames our engagement with our portfolio companies and fund managers on sustainability priorities.

We continually evolve and strengthen our ESG framework. Our ESG Investment Management team is an integral part of our Portfolio Strategy and Risk Group, helping to align and advance ESG considerations across all our investments.

Our internal carbon price guides decision making in line with broader climate targets and a growing urgency to address climate change. This price is used to model the likely future impact of carbon pricing on the investments we make and creates awareness of the societal costs that emissions will impose over time. It is currently US$50 per tonne of carbon dioxide equivalent (up from US$42 per tonne in 2021) and we expect to increase this price progressively, to US$100 by the end of this decade.

Our internal carbon price guides decision making in line with broader climate targets and a growing urgency to address climate change.

Apart from our direct investments, we continue to engage with the managers of the funds in which we have invested. We review the alignment of their focus with our ESG stance as well as the maturity of their ESG practices. The assessment will inform our future engagement with these fund managers and other like-minded investors, to encourage and support ESG practices and reporting for funds.

We continue to strengthen ESG capabilities across the firm. We provide ongoing training and guidance to our investment professionals and continuously improve our approach and processes. The ESG analysis is supplemented with input and data from external providers and advisors who complement internal diligence and research efforts. These efforts are overseen by a team of dedicated ESG professionals who act as a knowledge management and best practices resource centre for the firm.

Investing to Drive Sustainable and Inclusive Growth

We accelerated our investments and established new ventures and partnerships to support our aim of achieving a sustainable, inclusive and resilient world.

To accelerate the pace of decarbonisation, we launched GenZero in June 2022 as an investment platform company dedicated to catalysing solutions across three focus areas: technology-based solutions, nature-based solutions, and carbon ecosystem enablers.

Together with BlackRock, we formed Decarbonization Partners to advance decarbonisation solutions and accelerate global efforts to transition to net zero. The platform’s leadership team includes Temasek investment professionals who have transferred to the entity. We also became a founding partner of the Brookfield Global Transition Fund, which supports sustainable solutions around reducing greenhouse gas emissions, and energy consumption and capacity.

We leveraged the strengths of partners to drive efforts that achieve environmental impact at scale. Climate Impact X (CIX), which we established together with DBS, the Singapore Exchange, and Standard Chartered, is a global exchange and marketplace for high-quality carbon credits. CIX will offer platforms that provide curated carbon credits from a broad range of nature and technology-based projects to help companies decarbonise. In October 2021, CIX ran a pilot auction and about 170,000 carbon credits were auctioned off to 19 buyers. Further, in March 2022, CIX launched Project Marketplace, a platform which allows trusted and high-quality carbon credits to be listed, compared, bought and retired.

We also launched a partnership with HSBC, together with the Asian Development Bank and Clifford Capital as strategic partners, to establish a debt financing platform dedicated to sustainable infrastructure projects with an initial focus on Southeast Asia.

Over the year, we stepped up our investments into companies developing sustainable solutions. We invested in Ambercycle, a circular economy company which uses novel molecular separation technologies to recycle textiles into virgin-grade polyester. We also invested in several deep tech start-ups that aim to enable the transition to net zero such as Form Energy, an energy storage company that is developing a low cost and multi-day duration battery for grid applications; Fortera, which aims to enable the production of low carbon cement at scale; and H2Pro, a company that produces affordable green hydrogen fuel. We formed Sydrogen Energy, a joint venture with Nanofilm Technologies, which provides nanotechnology capabilities and solutions that enable mass adoption of hydrogen fuel systems. We also made a follow-on investment in Solugen, a specialty chemicals manufacturing platform that aims to decarbonise the chemicals industry. Post 31 March 2022, we invested in Perennial, an early stage start-up that uses remote sensing and Artificial Intelligence (AI) to accurately quantify soil carbon on farmland.

We established a dedicated Impact Investing team to generate positive impact for underserved communities while achieving market rate returns.

We established a dedicated Impact Investing team last year with a mandate to generate positive impact for underserved communities while achieving market rate returns. Beyond our strategic partnerships with ABC Impact and LeapFrog Investments, we committed to the latest funds managed by AXA IM Prime Impact, Elevar Equity and Quona Capital, with an aim to further build a diversified portfolio of impact funds.

Investing across Key Sectors and Geographies

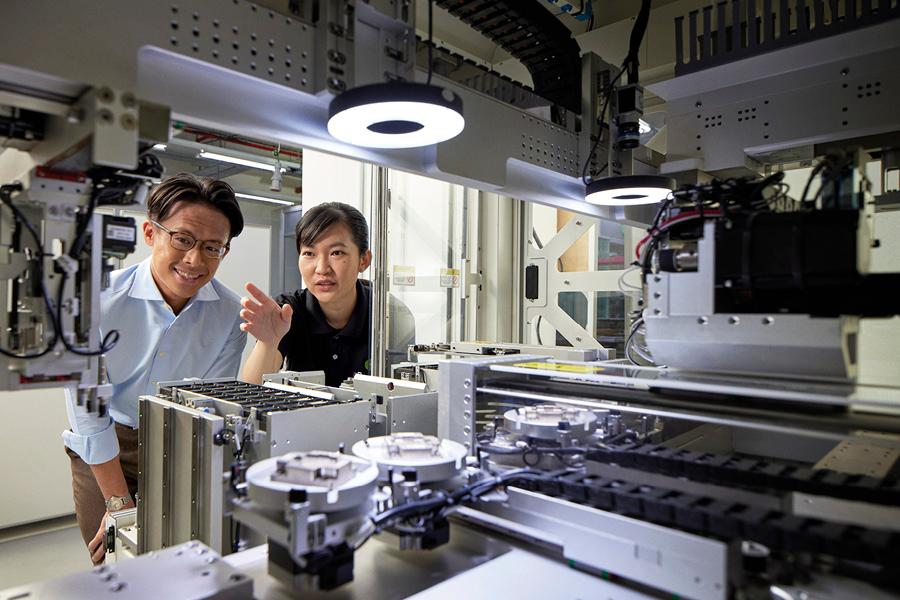

During the year, we invested in several technology and consumer-focused companies that are proxies to the structural trends we have identified. These included investments in AEM Holdings, an advanced semiconductor chip testing solutions provider; Orca, a multi-cloud cybersecurity platform; and waterdrop, a direct-to-consumer sustainability-driven beverage company. We also made follow-on investments in Snyk, a software developer of cybersecurity tools, and Taiwan Semiconductor Manufacturing Company, a contract manufacturer of semiconductor chips.

We increased our exposure to market infrastructure and wealth management companies in the financial services sector. These included investments in Forge, a US-based provider of marketplace infrastructure, data services and technology solutions for private market participants, and Institutional Capital Network, a US-based alternative investment platform that offers an integrated technology solution to the wealth management industry. We partnered BlackRock and China Construction Bank to establish a wealth management joint venture to meet the growing demand for diversified asset management solutions in China.

In the industrials & energy sectors, we invested in LG Energy Solution, a global supplier of rechargeable lithium-ion batteries for electric vehicles. We made follow-on investments in Commonwealth Fusion Systems, which is developing a fusion reactor that generates electricity, and Duravant, a global engineered equipment and automation solutions provider to the food processing, packaging and material handling sectors. We committed to increase our investment to become the majority shareholder of Element Materials Technology, a global leader in Testing, Inspection and Certification services headquartered in the UK.

In China, we continued to invest in the new economy sectors focusing on new consumption patterns, innovation and sustainability. These included Genki Forest, a healthy beverage company; Innovusion, an advanced mobility hardware and solutions provider; Orient Speech Therapy, a child behavioural health treatment centre chain; Shanghai Hydrogen Propulsion Technology, a hydrogen fuel cell developer; and Whale Technologies, a digital marketing tech company.

In India, we strengthened our technology and consumer portfolio by increasing our stakes in existing investments and investing in market leaders in emerging categories. We increased our investment in Ola, India’s largest online ride hailing company. We added new companies to our portfolio that align with structural trends such as Future of Consumption and Digitisation. Key new investments included Lenskart, India’s largest omni-channel eyewear retailer which uses technology to meet vision correction needs; and upGrad, an education technology company offering higher education and skill credentials in partnership with global universities.

In North America, we invested in Brooks Automation which provides high precision and high throughput robots and contamination control solutions to the semiconductor industry; Horizon Media, an agency connecting innovative brands to their customers; and Noom, a digital weight loss and wellness platform. We increased our stake in Pivot Bio, an agritech company that develops microbes which turn atmospheric nitrogen into sustainable nutrients for crops.

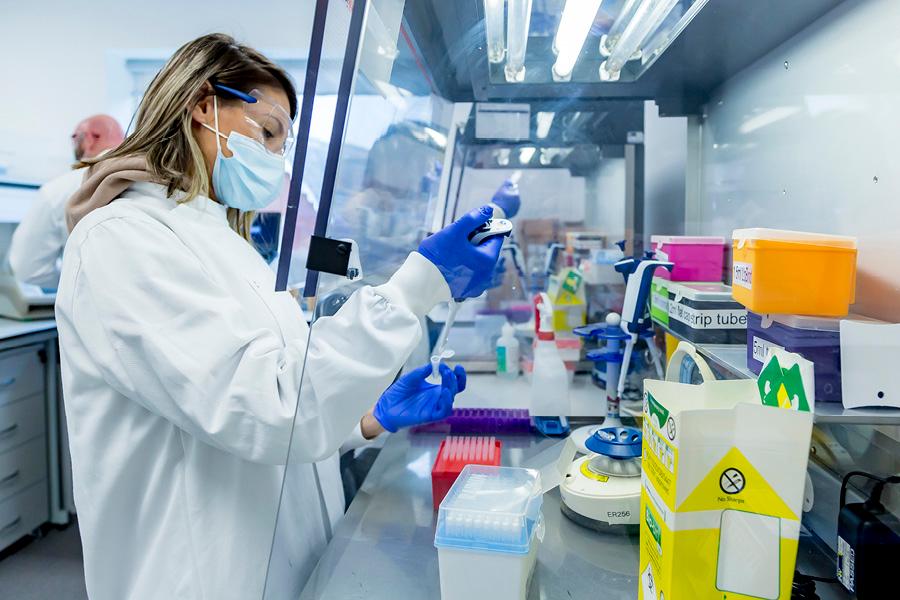

In Europe, we invested in Cambridge Epigenetix, a UK-based life sciences tools and technology company focused on genome sequencing; Hydrogenious, a Germany-based company that develops technologies and processes to enable safe, efficient and cost-competitive transport and storage of hydrogen; and Oxford Nanopore Technologies, a UK-based biotech company which provides scalable DNA sequencing technology.

Southeast Asia continues to offer attractive investment opportunities that ride on structural trends including a growing middle income population and a booming Internet economy. We invested in eFishery, an Indonesia-based start-up offering an end-to-end platform that provides fish and shrimp farmers with access to technology, feed and financing; and Golden Gate, a specialty F&B chain in Vietnam. We also made a follow-on investment in ShopBack, a regional shopping and consumer rewards platform.

Catalysing and Nurturing Innovation

We have started to develop our expertise in the areas of AI, Blockchain, Cyber and Digitisation. Our investments in these areas have started to add value to our ecosystem, and to catalyse the development of talents, products and solutions for the marketplace.

In the blockchain space, we invested in Amber, a global digital asset platform; ConsenSys, an Ethereum and decentralised protocols software company; cryptocurrency exchanges FTX and FTX US; and Immutable, a scalable platform for trading non-fungible tokens (NFTs) on Ethereum. Together with DBS and J.P. Morgan, we founded Partior, a blockchain platform that enables real time, cross-border and multi-currency payments.

Our AI pod launched Aicadium, a global AI Centre of Excellence, which aims to build deep expertise in AI and empower companies to accelerate the application of AI technologies. It is partnering some of our portfolio companies to co-innovate, develop and scale AI products to enable better commercial outcomes and catalyse new business opportunities. Aicadium also supports the development of NovA!, an AI technical platform under the National AI Programme in Finance which is a joint initiative by the Monetary Authority of Singapore (MAS) and the National AI Office at the Smart Nation and Digital Government Office. NovA! aims to leverage AI and machine learning to provide better insights for the financial services industry.

Our investments in AI, Blockchain, Cyber and Digitisation have started to add value to our ecosystem.

Our AI pod contributes to efforts to enhance the Singapore Model AI Governance Framework. It organised expert dialogues with industry players and published a thought leadership report on AI Ethics and Governance in Financial Services, which included contributions from MAS and the Infocomm Media Development Authority. Representing Temasek, the AI pod joined the Singapore Computer Society’s AI Ethics and Governance Certification Committee to promote requisite training and certification for professionals and bridge the trust gap required for AI adoption at scale by the industry.

We invested in innovative technology companies such as Autobrains, which develops Advanced Driver Assistance Systems for the autonomous driving sector; Covariant, which uses AI to automate manual tasks in the warehousing and logistics sector; Einride a Sweden-based transport company, which provides an electric and autonomous mobility platform that enables cost-effective and sustainable truck freight; and PortalOne, a Norway-based hybrid gaming company that is developing an immersive gaming platform.

With a keen eye on technology that will drive the future of computing, we invested in PsiQuantum, a company working to make quantum computing for general purposes a reality; and SambaNova, which is developing next generation AI architecture and software stack. We also formed a venture building company, Menyala, which aims to make disruptive technologies accessible and useful to people and businesses. The company will focus initially on Web3, the creator economy which allows people to earn revenue from their creations, and virtual worlds and experiences.

In partnership with UST, we set up a new company, Temus, to provide digital transformation solutions for the private and public sectors.

Positioning our Portfolio Companies for the Future

We participated in Singapore Airlines’ S$6.2 billion mandatory convertible bond issue in June 2021, which enabled the airline to have a strong balance sheet to navigate uncertainties and secure growth amidst the COVID-19 pandemic. We invested in Sembcorp Marine’s S$1.5 billion rights issue, which strengthened its balance sheet and liquidity position as well as accelerated its strategic pivot to high-growth renewable and clean energy segments. We also took part in Olam’s rights issue to fund the strategic acquisition of Olde Thompson, a US-based manufacturer of spices and seasonings, and the accelerated transformation of Olam Food Ingredients. In April 2022, Keppel and Sembcorp Marine announced that they have entered into definitive agreements for the proposed combination of Keppel Offshore & Marine and Sembcorp Marine. This is aimed at creating a premier global player focusing on offshore renewables, new energy and cleaner solutions in the offshore & marine sector.

Enabling Growth through Platforms

Heliconia is a growth fund set up in 2012 by Temasek to invest in promising small and medium enterprises in Singapore. During the year, it invested in several promising consumer and technology companies. This included Carousell, a consumer marketplace for buying and selling new and second-hand goods in Southeast Asia; Haulio, a digital platform which connects last-mile container haulers with shippers; and XM Studios, a designer and producer of luxury pop culture art collectibles. Heliconia also made follow-on investments in some of its portfolio companies such as Cariuma, a direct-to-consumer sustainable fashion brand; Flexxon, an industrial flash storage and memory solutions company; Glife, an agritech company that connects farms directly with F&B businesses and consumers; and Lucence Diagnostics, a precision oncology company that provides diagnostic and testing services for cancer.

Temasek jointly established EvolutionX Debt Capital, a US$500 million growth stage debt financing platform alongside DBS, to provide non-dilutive financing to growth stage technology-enabled companies across Asia, with a focus on China, India and Southeast Asia. EvolutionX will invest in opportunities arising from an increasingly digital economy across sectors such as financial services, consumer, healthcare, education and industrial development with the aim of accelerating growth and building the next generation of technology leaders.

Our existing platforms such as Azalea Investment Management, Clifford Capital, Fullerton Fund Management, InnoVen Capital, and Seatown Holdings International have continued to deliver returns while growing their businesses in an increasingly competitive environment.

We made a cornerstone investment into Vertex Venture Holdings’ first Special Purpose Acquisition Company, Vertex Technologies Acquisition Corporation, which successfully listed on the Singapore Stock Exchange in January 2022.

We set up 65 Equity Partners (65EP) last year to provide flexible capital solutions to family-owned and entrepreneur-led businesses in Singapore, Europe and the US. Headquartered in Singapore, the company has S$4.5 billion in funds under management, and has investment teams based in Singapore, London and San Francisco.