Group Cash Flow Statements

Jump to

In 2018, Temasek adopted the International Financial Reporting Standards (IFRS), in line with Singapore's convergence with IFRS. This included the adoption of IFRS 9: Financial Instruments in 2018 and IFRS 16: Leases in 2019. You can find out more information here.

| (From 2002 to 2022) | In S$ billion |

|---|

|

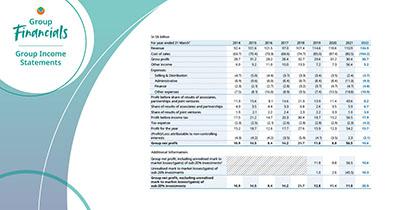

For year ended 31 March On 1 April 2018, the Group adopted International Financial Reporting Standards (IFRS). The Group also adopted new and amended IFRS and Interpretations of IFRS that were mandatory for application for the financial year ended 31 March 2019, which included IFRS 1: First-time adoption of IFRS, IFRS 9: Financial Instruments and IFRS 15: Revenue from Contracts with Customers. Changes in accounting policies as a result of IFRS 1 and IFRS 15 were applied retrospectively to the Group financial statements for the year ended 31 March 2018. The effects of adoption of IFRS 9 were recognised in the shareholder equity as at 1 April 2018. Comparative financial statements for the years ended 31 March 2002 to 2017 were prepared based on Singapore Financial Reporting Standards. |

|---|

| Operating cash flow before working capital changes |

| Change in working capital |

| Cash generated from operations |

| Income tax paid |

| Net cash inflow from operating activities |

| Net cash inflow/(outflow) from investing activities |

| Net cash inflow/(outflow) from financing activities |

|

Net increase/(decrease) in cash and cash equivalents held |

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 9.5 | 11.2 | 13.9 | 16.9 | 18.6 | 17.6 | 21.2 | 14.0 | 16.4 | 20.2 | 16.8 | 20.1 | 20.0 | 20.3 | 18.4 | 18.7 | 20.8 | 19.7 | 23.1 | 17.9 | 23.3 |

| 6.2 | 0.3 | (2.5) | (4.4) | 2.6 | 2.5 | (0.3) | 1.5 | (4.1) | (2.9) | (1.6) | (4.0) | (1.5) | (3.2) | (5.1) | (2.3) | (3.8) | (1.7) | (3.7) | (8.7) | (4.6) |

| 15.7 | 11.5 | 11.4 | 12.5 | 21.2 | 20.1 | 20.9 | 15.5 | 12.3 | 17.3 | 15.2 | 16.1 | 18.5 | 17.1 | 13.3 | 16.4 | 17.0 | 18.0 | 19.4 | 9.2 | 18.7 |

| (1.3) | (1.3) | (1.2) | (1.5) | (1.6) | (1.6) | (2.0) | (1.8) | (1.3) | (1.3) | (2.0) | (1.8) | (2.3) | (2.0) | (2.1) | (2.4) | (2.2) | (2.2) | (2.0) | (1.9) | (2.9) |

| 14.4 | 10.2 | 10.2 | 11.0 | 19.6 | 18.5 | 18.9 | 13.7 | 11.0 | 16.0 | 13.2 | 14.3 | 16.2 | 15.1 | 11.2 | 14.0 | 14.8 | 15.8 | 17.4 | 7.3 | 15.8 |

| (16.4) | (6.4) | (7.7) | (4.7) | (16.5) | (23.3) | (30.4) | 0.1 | (5.3) | (4.9) | (14.8) | (15.3) | (19.2) | (22.6) | (14.7) | (7.2) | (23.0) | (13.5) | (9.8) | (16.4) | (16.4) |

| 4.2 | (7.9) | 6.8 | (4.8) | (0.2) | 2.2 | 13.3 | (6.4) | (0.2) | (1.7) | (1.4) | 4.0 | 1.0 | 1.1 | 2.4 | 2.7 | 2.5 | 11.0 | 2.0 | 7.9 | 7.9 |

| 2.2 | (4.1) | 9.3 | 1.5 | 2.9 | (2.6) | 1.8 | 7.4 | 5.5 | 9.4 | (3.0) | 3.0 | (2.0) | (6.4) | (1.1) | 9.5 | (5.7) | 13.3 | 9.6 | (1.2) | 7.3 |